The IRR is calculated based on CalPERS records of cash flows and financial statements from the investment managers.ĥ7 Stars Global Opportunities Fund 2 (CalPERS), LLCĪdvent Global Technology II Limited PartnershipĪdvent International GPE IX Limited PartnershipĪdvent International GPE VIII-B Limited PartnershipĪdvent International GPE X Limited PartnershipĪlpInvest Secondaries Fund (onshore) VII, L.P.Īpollo European Principal Finance Fund, L.P.Īpollo Special Opportunities Managed Account, L.P.Īres Corporate Opportunities Fund II, L.P.Īres Corporate Opportunities Fund III, L.P.Īres Corporate Opportunities Fund V, L.P.Īres Corporate Opportunities Fund VI, L.P.Īvenue Asia Special Situations Fund IV, L.P.īaring Vostok Private Equity Fund IV L.P. Interim IRRs by themselves are not the best indicators of current or future fund performance. In evaluating private equity performance, CalPERS emphasizes using both the realized Internal Rate of Return (IRR) and Investment Multiple.

#Venture capital fund performance plus

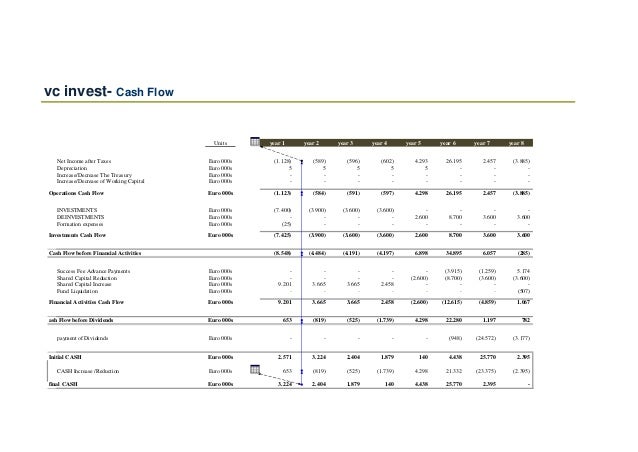

Cash Out & Remaining Value represents the distributions CalPERS has received plus the reported value of the invested capital.Cash Out represents distributions CalPERS has received back from the fund.Cash In represents capital contributed for investments and management fees.

The table is updated quarterly and provides information on the status of all active CalPERS private equity commitments it doesn't include any exited partnership investments.

0 kommentar(er)

0 kommentar(er)